straight life policy term

C Survivorship life policy. The death benefit of a straight life policy.

Free Term Life Vs Whole Life Insurance Calculator Insurance Geek

Straight life insurance is a type of permanent life insurance.

. A straight term insurance policy provides a benefit upon the death of the policyholder but ceases to provide. A straight life policy is an insurance policy that provides lifelong life insurance coverage with continuous level premium payments. A Joint life policy.

A life insurance policy that provides coverage only for a certain period of time. Difference between straight life insurance vs. Most term life insurance policies offer a level death benefit.

A straight term insurance policy. Decreasing term insurance is a type of annual renewable term life insurance that provides a death benefit that decreases at a predetermined rate over the life of the policy. This traditional life insurance is sometimes also known as.

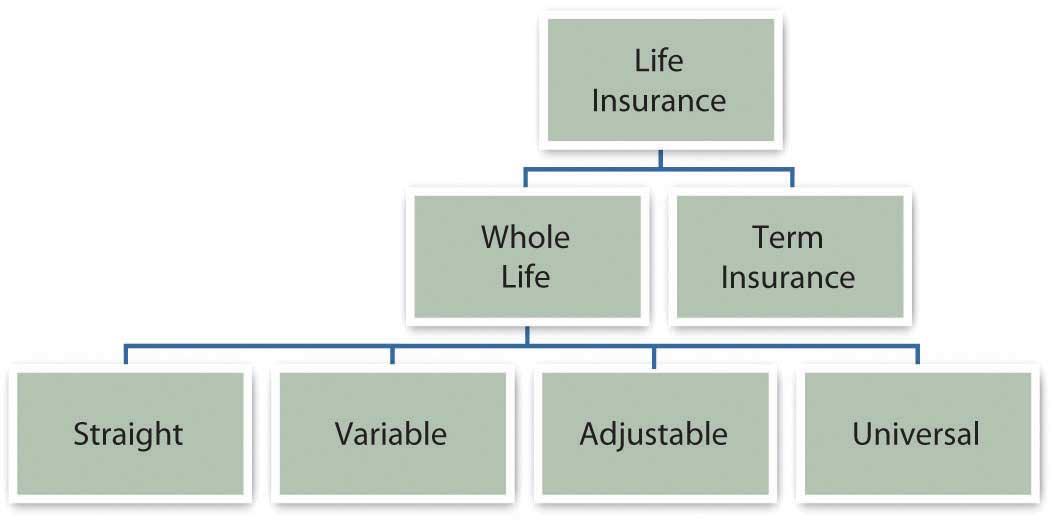

Straight Life Policy an ordinary life policy or whole life policy. While straight life insurance offers lifelong coverage term life insurance provides temporary life insurance coverage. D Modified endowment contract.

Issued in an amount not to exceed the amount of the loan. Straight life insurance policies are designed for those looking for protection guaranteed cash value growth. It is also known as whole life insurance.

See Your Rate and Apply Online. Also known as whole or ordinary life insurance the policy has a term length that lasts your entire life. The type of life policy he is looking for is called a.

A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefit. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or. 12222 Merit Drive Suite 1600 Dallas TX 75251-2266 972 960-7693 800 827-4242.

As with all whole life. A Joint life policy. A straight life insurance policy is a type of permanent insurance that provides a guaranteed death benefit and has fixed premiums.

Policy riders to protect your loved ones. Straight life policy term. B Family income policy.

International Risk Management Institute Inc. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefit. Straight Whole Life Insuranceor ordinary life provides permanent level protection with level premiums from the time the policy is issued until the insureds death.

A straight life insurance policy provides coverage for a lifetime with constant premiums throughout the policys term. Terms range between 1 year and 30 years depending on the plan offered by the.

The Complete Resource For Straight Whole Life Insurance

Protect Against Setbacks With Life Insurance Faithlife Financial Blog

Is A Straight Life Insurance Policy Right For You Wealth Nation

Bus 141 Chapter 20 Flashcards Quizlet

Is A Straight Life Policy Right For Me Paradigmlife Net Blog

Which Of These Characteristics Is Consistent With A Straight Life Policy Brainly Com

.jpg)

The 5 Biggest Life Insurance Mistakes Parents Are Making In 2021 Policyme

/glossary-of-must-know-sexual-identity-terms-5186275-ADD-Color-511efdd2cba44a59982fc82ab48cc9b1.png)

Glossary Of Must Know Sexual Identity Terms

Straight Life Insurance What Is It 2022

What Is Whole Life Insurance And How Does It Work Lincoln Heritage

What Is A Ppo Preferred Provider Organization Part 2 Types Of Health Insurance Dental Insurance Plans Health Insurance Plans

Johnathon Davis Johnath87228771 Twitter

International Experience Of Long Term Life Insurance A

Term Insurance Vs Permanent Cash Value Insurance Empyrion Wealth Management

Tips And Advice For Purchasing Life Insurance By Legalswamp7804 Issuu

Cain Orthodontics Myth 3 My Teeth Will Stay Straight Forever After Braces Following Finishing Treatment You Are Given A Clear Retainer That Is Crucial To Wear And Keep Up With